Most potential homeowners worry whether their home will retain its value over time. Some basic tips will help you understand how property values can change so much.

When you buy a house, you can get some financial incentives from the seller, effectively lowering how much the house will cost you. One common incentive is to request that the seller “buy down” your loan’s interest rate for the first one to two years. Adding financial incentives to your offer will make the seller more likely to stick to the selling price.

Always take the time to review your options before buying anything. It might take a while to locate the property that fits exactly what you are looking for.

Make sure ahead of time that you can come up with the down payment your mortgage company will need. If you can’t make a traditional down payment, then you may have to get private mortgage insurance. This can add a lot of money to your monthly expenses, because you need to prove to your bank that you will be able to afford paying your mortgage.

If you are looking to buy a new home, remember that there are more important things than decoration. You should base your decision on the condition and construction of the home. If you just base your decisions on appearance, you risk overlooking serious problems that will be expensive to fix later.

It is crucial that you take the time to investigate the neighborhood you will be living in before you make an investment. If the neighborhood does not fit your living needs, you will be greatly disappointed with your home in the long run. You need to know the neighborhood you are moving in so you know what you are getting yourself into.

If you can’t make a traditional down payment yet, look into assistance programs. This reduces what you need to save before buying a home, along with closing costs paid by the seller.

You can find a calculator online that will help you determine a reasonable price range when you are ready to purchase a house. These calculators allow you to enter many aspects of your financial situation for analysis. You will then have a idea of what price you can afford to pay for a home.

Right now is an opportune time to start investing in real estate. Property values are low due to a recent fall in the housing market. If you are financially secure, seize your chance to get a great piece of property at a low price. In time the market will correct itself, and the value of your investment will appreciate.

Buying home insurance is a necessity for anyone buying a house. It must be done prior to moving in. If you put this off your insurance will not cover anything that happens, disaster can happen at any time!

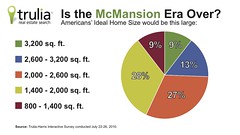

Square Footage

Take your time to carefully measure a home you are highly interested in buying. Be sure that the square footage given by the owner is the same as the square footage of public record. If the numbers don’t match up within 100 feet, then there is something fishy happening.

Oftentimes, homes that need major improvements are offered at lower prices. This offers the opportunity to purchase relatively inexpensively, and then make repairs or improvements on your own schedule. You can not only design your home in a manner that appeals to you, but you will also build equity with your improvements. Don’t allow the minor repairs to overshadow the potential the house may have. A few updates and improvements could transform that diamond in the rough into the house of your dreams.

You should always make plans to make repairs on a home that is foreclosed. Most foreclosed homes may have been sitting vacant for some time before going up for sale, meaning that regular maintenance has not been done. Foreclosed homes usually require pest control and a new HVAC system.

Most people do not think that buying a home is complicated. Use this advice to help you when making your next home purchase.